Knowledge Hub

Your health insurance, simplified

Our Knowledge Hub offers easy access to FAQs, educational guides, and expert insights to help you make the most of your benefits. Stay informed, save money and get the support you need—all in one place.

Choosing your plan

Learn the common health insurance lingo

Your crash course in common vocabulary and phrases in your health insurance.

HMO vs PPO: What's the difference?

Understand some of the basic differences between HMO and PPO plan types.

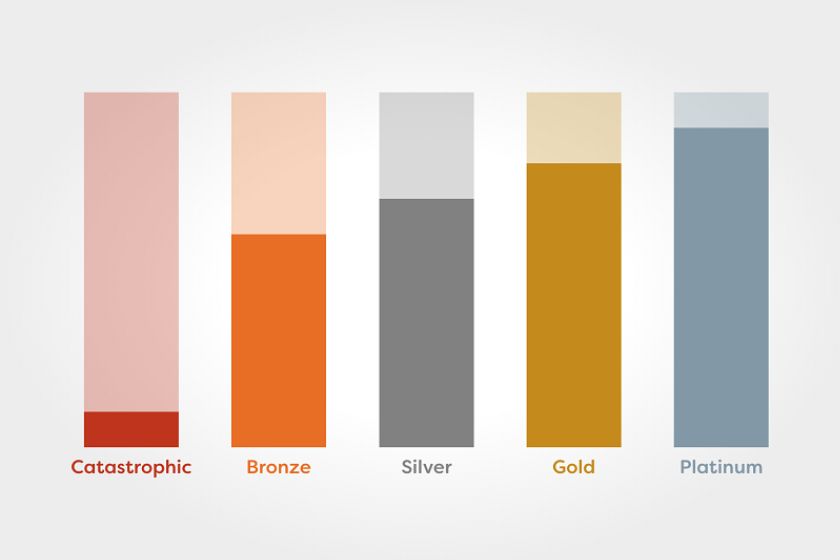

What are health insurance metal levels?

See how health plans are divided into: Bronze, Silver, Gold or Platinum.

4 things to know when picking a plan

Learn about how to estimate what you’ll need and how to tally how much you’ll pay.

Benefits & coverage

See what's included in a preventive visit

Learn more about the top things you'll do at your next appointment.

Get what you pay for: care you trust

See the different ways to access our network of 48,000+ providers.

10 ways to save on your healthcare

Here are some tips to help you get the best value out of your coverage.

Nutritional therapy for healthy habits

Many of our plans offer time with a dietician to help you stay on track.

FAQs for Members

The ACA marketplace, sometimes called the exchange or the Health Insurance Marketplace, is where you can buy health insurance plans for yourself and/or your family. Created by the Affordable Care Act (ACA), and often called Obamacare, it is designed to allow people to more easily compare plans, find out if they qualify for subsidies or Medicaid, and enroll in coverage.

Maine’s marketplace is called CoverME.gov. Marketplace plans are grouped into “metal levels:” Bronze, Silver, Gold and Platinum, which offer different levels of coverage based on your monthly premium and out-of-pocket costs.

Are you a Small Business? You can determine your eligibility to purchase a SHOP plan at CoverME.gov- we are the only carrier in Maine that offers tax credited health insurance coverage for your employees. You can purchase SHOP plans through our store front.

CoverME.gov is Maine's Health Insurance Marketplace. It is where people and small businesses in Maine can shop and buy health plans, along with finding out whether they qualify for MaineCare or financial assistance. Individuals and families can purchase a plan during annual Open Enrollment, Nov.1 through Dec. 15, or when they qualify for a Special Enrollment Period.

About 85% of enrollees qualify for financial savings. Depending on household income, household size and other factors, you could be eligible for:

- Premium tax credits to lower monthly payments

- Other savings to reduce costs when you get care

Our Member Services team is available to answer any questions and find the right plan for your unique needs: (855) 624-6463.

At Community Health Options, our purpose is simple: We provide Members with benefits they can actually use.

From the state’s broadest healthcare provider network to our Maine-based Member Services team that answers your questions instead of sending your employees down a robot rabbit hole, we focus on helping our Members get access to the care they need while working to lower out-of-pocket costs.

View our Small Group or Large Group plans

You can only change which health plan you have during specific times:

- Open Enrollment Period: This is the main time each year when you can sign up for or change your health plan. If you’re buying it on your own, you’ll have to sign up once a year, usually beginning in November (Nov. 15-Dec. 15 in Maine). Open Enrollment can vary from state to state.

If you get your insurance at work, your employer will generally schedule a specific open enrollment period.

- Special Enrollment Period (SEP): When your life changes—like starting a new job, having a baby, getting married or divorced, losing other health coverage or moving to a new area, that’s called a “qualifying life event.” In those cases, you can change your insurance or buy a new plan, whether you buy insurance on your own or get it at work.

To view our current coverage options, visit the Explore Plans page to get started. If you are looking for an Individual or Family plan and want to find out if you qualify for financial assistance, visit CoverME.gov and search for Community Health Options to see our plans. Our Member Services team is always here to answer any questions at (855) 624-6463.

For Group Members, please contact your employer’s HR administrator for details on your specific plan option.

The portal has everything you need to get started with your benefits plan. Setting up your secure, personal Member portal takes just a few minutes and gives you 24/7 online access to your plan benefits and documents.

Here’s how to get started:

- Go to login.healthoptions.org

- Click on First Time User? Sign up for an account below the gray sign-in box

- At the next screen, enter your Member ID number, last name and date of birth

Search for in-network options via our Provider Directory. To get the most accurate results tied to your specific plan, log into your Member portal account first and select Providers & Hospitals from the left-hand menu. Otherwise, manually enter your plan name via the All Plans button in the top right corner.

Haven’t set up a Member portal account yet? The portal gives you secure, 24/7 access to your plan and benefits information: create account.

A formulary is a list of prescription medications covered by your health insurance plan. You can search the ACA version right here. It includes:

- Medication names: Generic and brand-name versions of drugs

- Dosage forms: Tablets, capsules, injections, vials, etc.

- Tier status: the cost and coverage of the medication

Your specific plan may have a custom formulary as some plans differ. For the most accurate and up-to-date version of your formulary, we recommend signing into your Member portal.

Haven’t set up a Member portal account yet? The portal gives you secure, 24/7 access to your plan and benefits information: create account.